Banking Analytics Architecture provides a scalable business analytics framework for serving your analytical and business intelligence needs. The frame¬work takes data from multiple, disparate operational systems, then formats, cleanses, transforms and stores it in a central data warehouse.

Banking Analytics Architecture

Business Services

Banking Analytics Architecture

Consistent, single source of data for risk, regulatory compliance, fact-based decision making.

Overview

Inconsistent, incomplete and inaccurate data spread across multiple operational systems – such as deposits, loans and wealth management – often results in banking executives making business decisions based on “instinct” rather than reliable analysis.

Why SES?

SES delivers a solid foundation for imple¬menting an enterprise data warehouse that provides accurate insight into your business. By consolidating the vast amount of banking-related data into a single reposi¬tory, you can ensure consistent reporting across multiple business units – and that enables business managers to make fact-based decisions with confidence. You can then apply predictive analytic techniques, such as market basket analysis and decision trees, to the data to enhance reports and derive more proactive benefits.

Data that’s Consistent, Accurate, Verifiable and Up-to-Date

Access the data you need whenever and wherever you need to – and be confident in the validity and timeliness of that data. A banking data model lets you correct, stan¬dardize and verify data to provide accurate, up-to-date business intelligence and meet regulatory reporting requirements. You can also acquire and consolidate historical data from both internal and external sources for use in analysis and reporting.

A Complete, Integrated View of All Your Enterprise Data

A comprehensive data dictionary covers all key banking subject areas, including marketing, finance, risk and compliance across consumer and corporate banking, mortgage lending, wealth management and investment banking.

Clear, Structured Information for All Who Need It

Easy-to-use, web-based reporting makes it easy to communicate critical business infor¬mation to the right people within your insti¬tution. Comprehensive business intelligence capabilities meet the needs of every type of user, including:

No More Overlapping, Redundant Tools and Systems

The flexible, reliable Banking Analytics Architecture is a complete solution that supports all your data integration and reporting needs. It eliminates the piecemeal approach of linking and managing technol¬ogies from different vendors. It also lowers your overall costs, reduces risk and enables faster results.

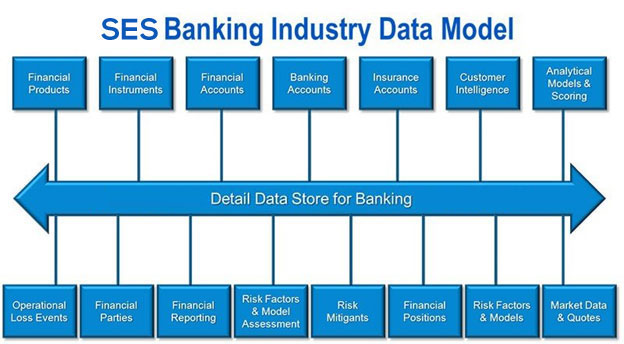

Banking Data Model

A comprehensive data model serves as a single version of the truth for an enterprise data warehouse that covers all key banking areas. The framework supports consumer and corpo¬rate banking, mortgage lending, wealth management and investment banking, and has the flexibility to extend to new lines of business. It also includes:

Industry Data Model

Request for Services

Find out more about how we can help your organization navigate its next. Let us know your areas of interest so that we can services you better.